Taxe : Différence entre versions

| Ligne 916 : | Ligne 916 : | ||

:➨ '''Message Écriture comptable''' : voir [[Taxe (Fiscal Tax)]] | :➨ '''Message Écriture comptable''' : voir [[Taxe (Fiscal Tax)]] | ||

:➨ '''Message Plan de comptes''' : voir [[Taxe (AAA Chart Of Accounts Tax)]] | :➨ '''Message Plan de comptes''' : voir [[Taxe (AAA Chart Of Accounts Tax)]] | ||

| + | <br> | ||

| + | === Exemple === | ||

| + | |||

| + | <table class=MsoTableGrid border=1 cellspacing=0 cellpadding=0 width=600 | ||

| + | style='width:450.0pt;margin-left:5.4pt;border-collapse:collapse;border:none'> | ||

| + | <tr> | ||

| + | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;padding: | ||

| + | 0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Identification : | ||

| + | Identifiant</span></p> | ||

| + | </td> | ||

| + | <td width=420 style='width:315.0pt;border:solid windowtext 1.0pt;border-left: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>[balise | ||

| + | non utilisée]</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Calculé : | ||

| + | Montant</span></p> | ||

| + | </td> | ||

| + | <td width=420 style='width:315.0pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>[balise | ||

| + | non utilisée]</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Type : | ||

| + | Code</span></p> | ||

| + | </td> | ||

| + | <td width=420 style='width:315.0pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>VAT</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Exonération : | ||

| + | Text</span></p> | ||

| + | </td> | ||

| + | <td width=420 style='width:315.0pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>[balise | ||

| + | non utilisée]</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Calculé : | ||

| + | Taux</span></p> | ||

| + | </td> | ||

| + | <td width=420 style='width:315.0pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>[balise | ||

| + | non utilisée]</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Séquence | ||

| + | de calcul : Numérique</span></p> | ||

| + | </td> | ||

| + | <td width=420 style='width:315.0pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>1</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Base : | ||

| + | Quantité</span></p> | ||

| + | </td> | ||

| + | <td width=420 style='width:315.0pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>[balise | ||

| + | non utilisée]</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Base : | ||

| + | Montant</span></p> | ||

| + | </td> | ||

| + | <td width=420 style='width:315.0pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>[balise | ||

| + | non utilisée]</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Catégorie : | ||

| + | Code</span></p> | ||

| + | </td> | ||

| + | <td width=420 style='width:315.0pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>E</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Monnaie : | ||

| + | Code</span></p> | ||

| + | </td> | ||

| + | <td width=420 style='width:315.0pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>EUR</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Juridiction : | ||

| + | Texte</span></p> | ||

| + | </td> | ||

| + | <td width=420 style='width:315.0pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>France</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Droits | ||

| + | de douane : Indicateur</span></p> | ||

| + | </td> | ||

| + | <td width=420 style='width:315.0pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>[balise | ||

| + | non utilisée]</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Exonération : | ||

| + | Code</span></p> | ||

| + | </td> | ||

| + | <td width=420 style='width:315.0pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>9</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Abattement | ||

| + | à la base : Taux</span></p> | ||

| + | </td> | ||

| + | <td width=420 style='width:315.0pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>[balise | ||

| + | non utilisée]</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | </table> | ||

| + | <br> | ||

=== Observations === | === Observations === | ||

Version du 19 juillet 2011 à 08:38

Contenu

|

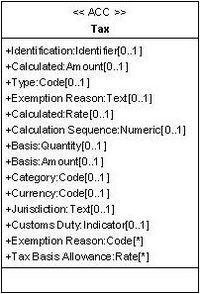

Tax |

Taxe |

Classe regroupant des informations concernant une date ou une période. |

Occurrence |

|

Identification: Identifier |

Identification : Identifiant |

Identification de la taxe. |

0..1 |

|

Calculated: Amount |

Calculé : Montant |

Indication du montant calculé de la taxe. |

0..1 |

|

Type: Code |

Type : Code |

Indication du type de taxe. |

0..1 |

|

Exemption Reason: Text |

Exonération : Text |

Indication en clair de l'exonération de taxe. |

0..1 |

|

Calculated: Rate |

Calculé : Taux |

Indication du taux de la taxe. |

0..1 |

|

Calculation Sequence: Numeric |

Séquence de calcul : Numérique |

Indication du rang de calcul de la taxe comme par exemple : rang 1 calcul de la taxe parafiscale, rang 2 calcul de la TVA. |

0..1 |

|

Basis: Quantity |

Base : Quantité |

Indication d'une quantité pouvant entrer dans le calcul d'une taxe. |

0..1 |

|

Basis: Amount |

Base : Montant |

Indication d'un montant pouvant entrer dans le calcul d'une taxe. |

0..1 |

|

Category: Code |

Catégorie : Code |

Indication de la catégorie pour laquelle la taxe s'applique comme par exemple taux standard, taxe non chargée (voir UNCL 5305). |

0..1 |

|

Currency: Code |

Monnaie : Code |

Indication du code la monnaie de la taxe. |

0..1 |

|

Jurisdiction: Text |

Juridiction : Texte |

Indication de la juridiction pour laquelle la taxe s'applique. |

0..1 |

|

Customs Duty: Indicator |

Droits de douane : Indicateur |

Indication si oui ou non la taxe concerne des droits de douane. Par défaut, non. |

0..1 |

|

Exemption Reason: Code |

Exonération : Code |

Indication du code de l'exonération de taxe. |

* |

|

Tax Basis Allowance: Rate |

Abattement à la base : Taux |

Indication du taux d'abattement pour calculer la taxe. |

* |

Indicateurs

|

Désignation |

Commentaire |

|

Droits de douane |

0 ou par défaut = non ; 1 = oui |

Table des codes

- ➨ Type de taxe : http://www.unece.org/uncefact/codelist/standard/UNECE_DutyTaxFeeTypeCode_D09B.xsd

et plus particulièrement, utilisation des codes suivants :

|

Code |

Désignation |

Commentaire |

|

CUD |

Customs duty |

Duties laid down in the Customs tariff, to which goods are liable on entering or leaving the Customs territory (CCC). |

|

ENV |

Environmental tax |

Tax assessed for funding or assuring environmental protection or clean-up. |

|

FRE |

Free |

No tax levied. |

|

GST |

Goods and services tax |

Tax levied on the final consumption of goods and services throughout the production and distribution chain. |

|

IMP |

Import tax |

Tax assessed on imports. |

|

SUR |

Surtax |

A tax or duty applied on and in addition to existing duties and taxes. |

|

TAC |

Alcohol mark tax |

A tax levied based on the type of alcohol being obtained. |

|

VAT |

Value added tax |

A tax on domestic or imported goods applied to the value added at each stage in the production/distribution cycle. |

- ➨ Catégorie de taxe : http://www.unece.org/uncefact/codelist/standard/UNECE_DutyorTaxorFeeCategoryCode_D09B.xsd

- ➨ Type de taxe : http://www.unece.org/uncefact/codelist/standard/UNECE_DutyTaxFeeTypeCode_D09B.xsd

et plus particulièrement, utilisation des codes suivants :

|

Code |

Désignation |

Commentaire |

|

A |

Mixed tax rate |

Code specifying that the rate is based on mixed tax. |

|

AA |

Lower rate |

Tax rate is lower than standard rate. |

|

AB |

Exempt for resale |

A tax category code indicating the item is tax exempt when the item is bought for future resale. |

|

AC |

Value Added Tax (VAT) not now due for payment |

A code to indicate that the Value Added Tax (VAT) amount which is due on the current invoice is to be paid on receipt of a separate VAT payment request. |

|

AD |

Value Added Tax (VAT) due from a previous invoice |

A code to indicate that the Value Added Tax (VAT) amount of a previous invoice is to be paid. |

|

B |

Transferred (VAT) |

VAT not to be paid to the issuer of the invoice but directly to relevant tax authority. |

|

C |

Duty paid by supplier |

Duty associated with shipment of goods is paid by the supplier; customer receives goods with duty paid. |

|

E |

Exempt from tax |

Code specifying that taxes are not applicable. |

|

G |

Free export item, tax not charged |

Code specifying that the item is free export and taxes are not charged. |

|

H |

Higher rate |

Code specifying a higher rate of duty or tax or fee. |

|

O |

Services outside scope of tax |

Code specifying that taxes are not applicable to the services. |

|

S |

Standard rate |

Code specifying the standard rate. |

|

Z |

Zero rated goods |

Code specifying that the goods are at a zero rate. |

- ➨ Monnaie : Voir table ISO 4217 http://www.iso.org/iso/fr/support/faqs/faqs_widely_used_standards/widely_used_standards_other/currency_codes/currency_codes_list-1.htm

- ➨ Exonération : http://www.unece.org/uncefact/codelist/standard/EDIFICASEU_TaxExemptionReason_D09B.xsd

Approche contextuelle

- ➨ Message Écriture comptable : voir Taxe (Fiscal Tax)

- ➨ Message Plan de comptes : voir Taxe (AAA Chart Of Accounts Tax)

Exemple

|

Identification : Identifiant |

[balise non utilisée] |

|

Calculé : Montant |

[balise non utilisée] |

|

Type : Code |

VAT |

|

Exonération : Text |

[balise non utilisée] |

|

Calculé : Taux |

[balise non utilisée] |

|

Séquence de calcul : Numérique |

1 |

|

Base : Quantité |

[balise non utilisée] |

|

Base : Montant |

[balise non utilisée] |

|

Catégorie : Code |

E |

|

Monnaie : Code |

EUR |

|

Juridiction : Texte |

France |

|

Droits de douane : Indicateur |

[balise non utilisée] |

|

Exonération : Code |

9 |

|

Abattement à la base : Taux |

[balise non utilisée] |