|

|

| (8 révisions intermédiaires par le même utilisateur non affichées) |

| Ligne 1 : |

Ligne 1 : |

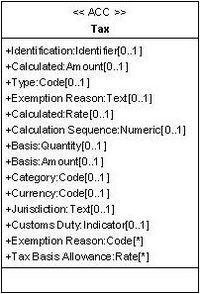

| − | [[Image:Tax.jpg|center|200px|]]

| + | {{cc_Taxe}} |

| − | <br>

| + | |

| − | <table class=MsoNormalTable border=1 cellspacing=0 cellpadding=0 width=1017

| + | |

| − | style='width:762.55pt;margin-left:5.4pt;border-collapse:collapse;border:none'>

| + | |

| − | <tr>

| + | |

| − | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;background:

| + | |

| − | #FFFF99;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><b><span style='font-size:

| + | |

| − | 9.0pt;font-family:"Arial","sans-serif";font-style:normal'>Tax</span></b></p>

| + | |

| − | </td>

| + | |

| − | <td width=262 style='width:196.2pt;border:solid windowtext 1.0pt;border-left:

| + | |

| − | none;background:#FFFF99;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><b><span style='font-size:

| + | |

| − | 9.0pt;font-family:"Arial","sans-serif";font-style:normal'>Taxe</span></b></p>

| + | |

| − | </td>

| + | |

| − | <td width=401 style='width:300.8pt;border:solid windowtext 1.0pt;border-left:

| + | |

| − | none;background:#FFFF99;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1><b><span style='font-size:9.0pt;font-family:"Arial","sans-serif";

| + | |

| − | font-style:normal'>Classe regroupant des informations concernant une date ou

| + | |

| − | une période.</span></b></p>

| + | |

| − | </td>

| + | |

| − | <td width=81 style='width:60.85pt;border:solid windowtext 1.0pt;border-left:

| + | |

| − | none;background:#FFFF99;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='text-align:center'><b><span

| + | |

| − | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>Occurrence</span></b></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Identification:

| + | |

| − | Identifier</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=262 style='width:196.2pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Identification :

| + | |

| − | Identifiant</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=401 style='width:300.8pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Identification de la

| + | |

| − | taxe.</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=81 style='width:60.85pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='text-align:center'><span

| + | |

| − | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Calculated: Amount</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=262 style='width:196.2pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Calculé : Montant</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=401 style='width:300.8pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Indication du montant

| + | |

| − | calculé de la taxe.</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=81 style='width:60.85pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='text-align:center'><span

| + | |

| − | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Type: Code</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=262 style='width:196.2pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Type : Code</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=401 style='width:300.8pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Indication du type de

| + | |

| − | taxe.</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=81 style='width:60.85pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='text-align:center'><span

| + | |

| − | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Exemption Reason: Text</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=262 style='width:196.2pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Exonération : Text</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=401 style='width:300.8pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Indication en clair de

| + | |

| − | l'exonération de taxe.</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=81 style='width:60.85pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='text-align:center'><span

| + | |

| − | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Calculated: Rate</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=262 style='width:196.2pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Calculé : Taux</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=401 style='width:300.8pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Indication du taux de la

| + | |

| − | taxe.</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=81 style='width:60.85pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='text-align:center'><span

| + | |

| − | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Calculation Sequence:

| + | |

| − | Numeric</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=262 style='width:196.2pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Séquence de calcul :

| + | |

| − | Numérique</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=401 style='width:300.8pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Indication du rang de

| + | |

| − | calcul de la taxe comme par exemple : rang 1 calcul de la taxe

| + | |

| − | parafiscale, rang 2 calcul de la TVA.</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=81 style='width:60.85pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='text-align:center'><span

| + | |

| − | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Basis: Quantity</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=262 style='width:196.2pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Base : Quantité</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=401 style='width:300.8pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Indication d'une quantité

| + | |

| − | pouvant entrer dans le calcul d'une taxe.</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=81 style='width:60.85pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='text-align:center'><span

| + | |

| − | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Basis: Amount</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=262 style='width:196.2pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Base : Montant</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=401 style='width:300.8pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Indication d'un montant

| + | |

| − | pouvant entrer dans le calcul d'une taxe.</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=81 style='width:60.85pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='text-align:center'><span

| + | |

| − | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Category: Code</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=262 style='width:196.2pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Catégorie : Code</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=401 style='width:300.8pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Indication de la

| + | |

| − | catégorie pour laquelle la taxe s'applique comme par exemple taux standard,

| + | |

| − | taxe non chargée (voir UNCL 5305).</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=81 style='width:60.85pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='text-align:center'><span

| + | |

| − | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Currency: Code</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=262 style='width:196.2pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Monnaie : Code</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=401 style='width:300.8pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Indication du code la

| + | |

| − | monnaie de la taxe.</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=81 style='width:60.85pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='text-align:center'><span

| + | |

| − | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Jurisdiction: Text</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=262 style='width:196.2pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Juridiction : Texte</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=401 style='width:300.8pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Indication de la

| + | |

| − | juridiction pour laquelle la taxe s'applique.</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=81 style='width:60.85pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='text-align:center'><span

| + | |

| − | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Customs Duty: Indicator</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=262 style='width:196.2pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Droits de douane :

| + | |

| − | Indicateur</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=401 style='width:300.8pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Indication si oui ou non

| + | |

| − | la taxe concerne des droits de douane. Par défaut, non.</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=81 style='width:60.85pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='text-align:center'><span

| + | |

| − | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Exemption Reason: Code</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=262 style='width:196.2pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Exonération : Code</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=401 style='width:300.8pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Indication du code de

| + | |

| − | l'exonération de taxe.</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=81 style='width:60.85pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='text-align:center'><span

| + | |

| − | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>*</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Tax Basis Allowance: Rate</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=262 style='width:196.2pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Abattement à la

| + | |

| − | base : Taux</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=401 style='width:300.8pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt;

| + | |

| − | font-family:"Arial","sans-serif";font-style:normal'>Indication du taux

| + | |

| − | d'abattement pour calculer la taxe.</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=81 style='width:60.85pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='text-align:center'><span

| + | |

| − | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>*</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | </table>

| + | |

| − | <br>

| + | |

| − | === Indicateurs ===

| + | |

| | | | |

| − | <table class=MsoNormalTable border=1 cellspacing=0 cellpadding=0 width=600

| + | === Approche contextuelle === |

| − | style='width:450.0pt;margin-left:5.4pt;border-collapse:collapse;border:none'>

| + | |

| − | <tr>

| + | |

| − | <td width=252 style='width:189.0pt;border:solid windowtext 1.0pt;background:

| + | |

| − | #FFCC99;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='page-break-after:avoid'><b><span

| + | |

| − | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>Désignation</span></b></p>

| + | |

| − | </td>

| + | |

| − | <td width=348 style='width:261.0pt;border:solid windowtext 1.0pt;border-left:

| + | |

| − | none;background:#FFCC99;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='text-align:justify;page-break-after:avoid'><b><span

| + | |

| − | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>Commentaire</span></b></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=252 style='width:189.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt;page-break-after:

| + | |

| − | avoid'><span style='font-size:9.0pt;font-family:"Arial","sans-serif";

| + | |

| − | font-style:normal'>Droits de douane </span></p>

| + | |

| − | </td>

| + | |

| − | <td width=348 style='width:261.0pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt;page-break-after:

| + | |

| − | avoid'><span style='font-size:9.0pt;font-family:"Arial","sans-serif";

| + | |

| − | font-style:normal'>0 ou par défaut = non ; 1 = oui </span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | </table>

| + | |

| − | <br>

| + | |

| − | === Table des codes ===

| + | |

| | | | |

| − | :➨ '''Type de taxe''' : http://www.unece.org/uncefact/codelist/standard/UNECE_DutyTaxFeeTypeCode_D09B.xsd | + | :➨ '''Message Écriture comptable''' : voir [[Taxe (Fiscal Tax)]] |

| − | ::<p class=Commentaire1><span style='font-style:normal'>et plus particulièrement, utilisation des codes suivants :</span></p>

| + | :➨ '''Message Grand livre''' : voir [[Taxe (AAA Ledger Tax)]] |

| − | | + | :➨ '''Message Plan de comptes''' : voir [[Taxe (AAA Chart Of Accounts Tax)]] |

| − | <div align=center>

| + | |

| − | | + | |

| − | <table class=MsoTableGrid border=1 cellspacing=0 cellpadding=0 width=600

| + | |

| − | style='width:450.0pt;margin-left:5.4pt;border-collapse:collapse;border:none'>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;background:

| + | |

| − | #CCFFCC;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='text-align:center'><b><span

| + | |

| − | style='font-size:9.0pt;font-style:normal'>Code</span></b></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border:solid windowtext 1.0pt;border-left:

| + | |

| − | none;background:#CCFFCC;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1><b><span style='font-size:9.0pt;font-style:normal'>Désignation</span></b></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border:solid windowtext 1.0pt;border-left:

| + | |

| − | none;background:#CCFFCC;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1><b><span style='font-size:9.0pt;font-style:normal'>Commentaire</span></b></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='margin:0cm;margin-bottom:.0001pt;

| + | |

| − | text-align:center'><span style='font-size:9.0pt;font-style:normal'>CUD</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | style='font-size:9.0pt;font-style:normal'>Customs duty</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>Duties laid down in the

| + | |

| − | Customs tariff, to which goods are liable on entering or leaving the Customs

| + | |

| − | territory (CCC).</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='margin:0cm;margin-bottom:.0001pt;

| + | |

| − | text-align:center'><span style='font-size:9.0pt;font-style:normal'>ENV</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | style='font-size:9.0pt;font-style:normal'>Environmental tax</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>Tax assessed for funding

| + | |

| − | or assuring environmental protection or clean-up.</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='margin:0cm;margin-bottom:.0001pt;

| + | |

| − | text-align:center'><span style='font-size:9.0pt;font-style:normal'>FRE</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | style='font-size:9.0pt;font-style:normal'>Free</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | style='font-size:9.0pt;font-style:normal'>No tax levied.</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='margin:0cm;margin-bottom:.0001pt;

| + | |

| − | text-align:center'><span style='font-size:9.0pt;font-style:normal'>GST</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | style='font-size:9.0pt;font-style:normal'>Goods and services tax</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>Tax levied on the final

| + | |

| − | consumption of goods and services throughout the production and distribution chain.</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='margin:0cm;margin-bottom:.0001pt;

| + | |

| − | text-align:center'><span style='font-size:9.0pt;font-style:normal'>IMP</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | style='font-size:9.0pt;font-style:normal'>Import tax</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | style='font-size:9.0pt;font-style:normal'>Tax assessed on imports.</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='margin:0cm;margin-bottom:.0001pt;

| + | |

| − | text-align:center'><span style='font-size:9.0pt;font-style:normal'>SUR</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | style='font-size:9.0pt;font-style:normal'>Surtax</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>A tax or duty applied on

| + | |

| − | and in addition to existing duties and taxes.</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='margin:0cm;margin-bottom:.0001pt;

| + | |

| − | text-align:center'><span style='font-size:9.0pt;font-style:normal'>TAC</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | style='font-size:9.0pt;font-style:normal'>Alcohol mark tax</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>A tax levied based on

| + | |

| − | the type of alcohol being obtained.</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='margin:0cm;margin-bottom:.0001pt;

| + | |

| − | text-align:center'><span style='font-size:9.0pt;font-style:normal'>VAT</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | style='font-size:9.0pt;font-style:normal'>Value added tax</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>A tax on domestic or

| + | |

| − | imported goods applied to the value added at each stage in the

| + | |

| − | production/distribution cycle.</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | </table></div align=center>

| + | |

| − | :➨ '''Catégorie de taxe''' : http://www.unece.org/uncefact/codelist/standard/UNECE_DutyorTaxorFeeCategoryCode_D09B.xsd | + | |

| − | :➨ '''Type de taxe''' : http://www.unece.org/uncefact/codelist/standard/UNECE_DutyTaxFeeTypeCode_D09B.xsd | + | |

| − | ::<p class=Commentaire1><span style='font-style:normal'>et plus particulièrement, utilisation des codes suivants :</span></p>

| + | |

| − | | + | |

| − | <div align=center>

| + | |

| − | <table class=MsoTableGrid border=1 cellspacing=0 cellpadding=0 width=600

| + | |

| − | style='width:450.0pt;margin-left:5.4pt;border-collapse:collapse;border:none'>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;background:

| + | |

| − | #CCFFCC;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='text-align:center'><b><span

| + | |

| − | style='font-size:9.0pt;font-style:normal'>Code</span></b></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border:solid windowtext 1.0pt;border-left:

| + | |

| − | none;background:#CCFFCC;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1><b><span style='font-size:9.0pt;font-style:normal'>Désignation</span></b></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border:solid windowtext 1.0pt;border-left:

| + | |

| − | none;background:#CCFFCC;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1><b><span style='font-size:9.0pt;font-style:normal'>Commentaire</span></b></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='margin:0cm;margin-bottom:.0001pt;

| + | |

| − | text-align:center'><span style='font-size:9.0pt;font-style:normal'>A</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | style='font-size:9.0pt;font-style:normal'>Mixed tax rate</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>Code specifying that the

| + | |

| − | rate is based on mixed tax.</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='margin:0cm;margin-bottom:.0001pt;

| + | |

| − | text-align:center'><span style='font-size:9.0pt;font-style:normal'>AA</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | style='font-size:9.0pt;font-style:normal'>Lower rate</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>Tax rate is lower than

| + | |

| − | standard rate.</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='margin:0cm;margin-bottom:.0001pt;

| + | |

| − | text-align:center'><span style='font-size:9.0pt;font-style:normal'>AB</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | style='font-size:9.0pt;font-style:normal'>Exempt for resale</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>A tax category code indicating

| + | |

| − | the item is tax exempt when the item is bought for future resale.</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='margin:0cm;margin-bottom:.0001pt;

| + | |

| − | text-align:center'><span style='font-size:9.0pt;font-style:normal'>AC</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>Value Added Tax (VAT)

| + | |

| − | not now due for payment</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>A code to indicate that

| + | |

| − | the Value Added Tax (VAT) amount which is due on the current invoice is to be

| + | |

| − | paid on receipt of a separate VAT payment request.</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='margin:0cm;margin-bottom:.0001pt;

| + | |

| − | text-align:center'><span style='font-size:9.0pt;font-style:normal'>AD</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>Value Added Tax (VAT)

| + | |

| − | due from a previous invoice</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>A code to indicate that

| + | |

| − | the Value Added Tax (VAT) amount of a previous invoice is to be paid.</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='margin:0cm;margin-bottom:.0001pt;

| + | |

| − | text-align:center'><span style='font-size:9.0pt;font-style:normal'>B</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | style='font-size:9.0pt;font-style:normal'>Transferred (VAT)</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>VAT not to be paid to

| + | |

| − | the issuer of the invoice but directly to relevant tax authority.</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='margin:0cm;margin-bottom:.0001pt;

| + | |

| − | text-align:center'><span style='font-size:9.0pt;font-style:normal'>C</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | style='font-size:9.0pt;font-style:normal'>Duty paid by supplier</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>Duty associated with

| + | |

| − | shipment of goods is paid by the supplier; customer receives goods with duty

| + | |

| − | paid.</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='margin:0cm;margin-bottom:.0001pt;

| + | |

| − | text-align:center'><span style='font-size:9.0pt;font-style:normal'>E</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | style='font-size:9.0pt;font-style:normal'>Exempt from tax</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>Code specifying that

| + | |

| − | taxes are not applicable.</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='margin:0cm;margin-bottom:.0001pt;

| + | |

| − | text-align:center'><span style='font-size:9.0pt;font-style:normal'>G</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>Free export item, tax

| + | |

| − | not charged</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>Code specifying that the

| + | |

| − | item is free export and taxes are not charged.</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='margin:0cm;margin-bottom:.0001pt;

| + | |

| − | text-align:center'><span style='font-size:9.0pt;font-style:normal'>H</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | style='font-size:9.0pt;font-style:normal'>Higher rate</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>Code specifying a higher

| + | |

| − | rate of duty or tax or fee.</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='margin:0cm;margin-bottom:.0001pt;

| + | |

| − | text-align:center'><span style='font-size:9.0pt;font-style:normal'>O</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>Services outside scope

| + | |

| − | of tax</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>Code specifying that

| + | |

| − | taxes are not applicable to the services.</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='margin:0cm;margin-bottom:.0001pt;

| + | |

| − | text-align:center'><span style='font-size:9.0pt;font-style:normal'>S</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | style='font-size:9.0pt;font-style:normal'>Standard rate</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>Code specifying the

| + | |

| − | standard rate.</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | <tr>

| + | |

| − | <td width=48 style='width:36.0pt;border:solid windowtext 1.0pt;border-top:

| + | |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 align=center style='margin:0cm;margin-bottom:.0001pt;

| + | |

| − | text-align:center'><span style='font-size:9.0pt;font-style:normal'>Z</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=205 style='width:153.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | style='font-size:9.0pt;font-style:normal'>Zero rated goods</span></p>

| + | |

| − | </td>

| + | |

| − | <td width=347 style='width:260.5pt;border-top:none;border-left:none;

| + | |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| + | |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| + | |

| − | <p class=Commentaire1 style='margin:0cm;margin-bottom:.0001pt'><span

| + | |

| − | lang=EN-US style='font-size:9.0pt;font-style:normal'>Code specifying that the

| + | |

| − | goods are at a zero rate.</span></p>

| + | |

| − | </td>

| + | |

| − | </tr>

| + | |

| − | </table></div align=center>

| + | |

| − | :➨ '''Monnaie''' : Voir table ISO 4217 http://www.iso.org/iso/fr/support/faqs/faqs_widely_used_standards/widely_used_standards_other/currency_codes/currency_codes_list-1.htm

| + | |

| − | :➨ '''Exonération''' : http://www.unece.org/uncefact/codelist/standard/EDIFICASEU_TaxExemptionReason_D09B.xsd

| + | |

| − | | + | |

| − | | + | |

| − |

| + | |

| − | === Observations ===

| + | |

| − | <br>

| + | |

| | <br> | | <br> |

| | <br> | | <br> |

| | <span style="color:#118040;">➨</span> [[Core Components|<span style="color:#994C6A;">Retour au sommaire</span>]] | | <span style="color:#118040;">➨</span> [[Core Components|<span style="color:#994C6A;">Retour au sommaire</span>]] |