Taxe : Différence entre versions

(Page créée avec « Image:Tax.jpg === Observations === <br> <br> <br> <span style="color:#118040;">➨</span> [[Core Components|<span style="color:#994C6A... ») |

|||

| Ligne 1 : | Ligne 1 : | ||

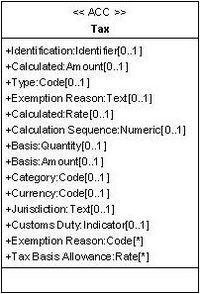

[[Image:Tax.jpg|center|200px|]] | [[Image:Tax.jpg|center|200px|]] | ||

| − | + | <br> | |

| + | <table class=MsoNormalTable border=1 cellspacing=0 cellpadding=0 width=1017 | ||

| + | style='width:762.55pt;margin-left:5.4pt;border-collapse:collapse;border:none'> | ||

| + | <tr> | ||

| + | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;background: | ||

| + | #FFFF99;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><b><span style='font-size: | ||

| + | 9.0pt;font-family:"Arial","sans-serif";font-style:normal'>Tax</span></b></p> | ||

| + | </td> | ||

| + | <td width=262 style='width:196.2pt;border:solid windowtext 1.0pt;border-left: | ||

| + | none;background:#FFFF99;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><b><span style='font-size: | ||

| + | 9.0pt;font-family:"Arial","sans-serif";font-style:normal'>Taxe</span></b></p> | ||

| + | </td> | ||

| + | <td width=401 style='width:300.8pt;border:solid windowtext 1.0pt;border-left: | ||

| + | none;background:#FFFF99;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1><b><span style='font-size:9.0pt;font-family:"Arial","sans-serif"; | ||

| + | font-style:normal'>Classe regroupant des informations concernant une date ou | ||

| + | une période.</span></b></p> | ||

| + | </td> | ||

| + | <td width=81 style='width:60.85pt;border:solid windowtext 1.0pt;border-left: | ||

| + | none;background:#FFFF99;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 align=center style='text-align:center'><b><span | ||

| + | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>Occurrence</span></b></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Identification: | ||

| + | Identifier</span></p> | ||

| + | </td> | ||

| + | <td width=262 style='width:196.2pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Identification : | ||

| + | Identifiant</span></p> | ||

| + | </td> | ||

| + | <td width=401 style='width:300.8pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Identification de la | ||

| + | taxe.</span></p> | ||

| + | </td> | ||

| + | <td width=81 style='width:60.85pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 align=center style='text-align:center'><span | ||

| + | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Calculated: Amount</span></p> | ||

| + | </td> | ||

| + | <td width=262 style='width:196.2pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Calculé : Montant</span></p> | ||

| + | </td> | ||

| + | <td width=401 style='width:300.8pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Indication du montant | ||

| + | calculé de la taxe.</span></p> | ||

| + | </td> | ||

| + | <td width=81 style='width:60.85pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 align=center style='text-align:center'><span | ||

| + | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Type: Code</span></p> | ||

| + | </td> | ||

| + | <td width=262 style='width:196.2pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Type : Code</span></p> | ||

| + | </td> | ||

| + | <td width=401 style='width:300.8pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Indication du type de | ||

| + | taxe.</span></p> | ||

| + | </td> | ||

| + | <td width=81 style='width:60.85pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 align=center style='text-align:center'><span | ||

| + | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Exemption Reason: Text</span></p> | ||

| + | </td> | ||

| + | <td width=262 style='width:196.2pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Exonération : Text</span></p> | ||

| + | </td> | ||

| + | <td width=401 style='width:300.8pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Indication en clair de | ||

| + | l'exonération de taxe.</span></p> | ||

| + | </td> | ||

| + | <td width=81 style='width:60.85pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 align=center style='text-align:center'><span | ||

| + | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Calculated: Rate</span></p> | ||

| + | </td> | ||

| + | <td width=262 style='width:196.2pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Calculé : Taux</span></p> | ||

| + | </td> | ||

| + | <td width=401 style='width:300.8pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Indication du taux de la | ||

| + | taxe.</span></p> | ||

| + | </td> | ||

| + | <td width=81 style='width:60.85pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 align=center style='text-align:center'><span | ||

| + | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Calculation Sequence: | ||

| + | Numeric</span></p> | ||

| + | </td> | ||

| + | <td width=262 style='width:196.2pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Séquence de calcul : | ||

| + | Numérique</span></p> | ||

| + | </td> | ||

| + | <td width=401 style='width:300.8pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Indication du rang de | ||

| + | calcul de la taxe comme par exemple : rang 1 calcul de la taxe | ||

| + | parafiscale, rang 2 calcul de la TVA.</span></p> | ||

| + | </td> | ||

| + | <td width=81 style='width:60.85pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 align=center style='text-align:center'><span | ||

| + | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Basis: Quantity</span></p> | ||

| + | </td> | ||

| + | <td width=262 style='width:196.2pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Base : Quantité</span></p> | ||

| + | </td> | ||

| + | <td width=401 style='width:300.8pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Indication d'une quantité | ||

| + | pouvant entrer dans le calcul d'une taxe.</span></p> | ||

| + | </td> | ||

| + | <td width=81 style='width:60.85pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 align=center style='text-align:center'><span | ||

| + | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Basis: Amount</span></p> | ||

| + | </td> | ||

| + | <td width=262 style='width:196.2pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Base : Montant</span></p> | ||

| + | </td> | ||

| + | <td width=401 style='width:300.8pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Indication d'un montant | ||

| + | pouvant entrer dans le calcul d'une taxe.</span></p> | ||

| + | </td> | ||

| + | <td width=81 style='width:60.85pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 align=center style='text-align:center'><span | ||

| + | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Category: Code</span></p> | ||

| + | </td> | ||

| + | <td width=262 style='width:196.2pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Catégorie : Code</span></p> | ||

| + | </td> | ||

| + | <td width=401 style='width:300.8pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Indication de la | ||

| + | catégorie pour laquelle la taxe s'applique comme par exemple taux standard, | ||

| + | taxe non chargée (voir UNCL 5305).</span></p> | ||

| + | </td> | ||

| + | <td width=81 style='width:60.85pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 align=center style='text-align:center'><span | ||

| + | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Currency: Code</span></p> | ||

| + | </td> | ||

| + | <td width=262 style='width:196.2pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Monnaie : Code</span></p> | ||

| + | </td> | ||

| + | <td width=401 style='width:300.8pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Indication du code la | ||

| + | monnaie de la taxe.</span></p> | ||

| + | </td> | ||

| + | <td width=81 style='width:60.85pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 align=center style='text-align:center'><span | ||

| + | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Jurisdiction: Text</span></p> | ||

| + | </td> | ||

| + | <td width=262 style='width:196.2pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Juridiction : Texte</span></p> | ||

| + | </td> | ||

| + | <td width=401 style='width:300.8pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Indication de la | ||

| + | juridiction pour laquelle la taxe s'applique.</span></p> | ||

| + | </td> | ||

| + | <td width=81 style='width:60.85pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 align=center style='text-align:center'><span | ||

| + | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Customs Duty: Indicator</span></p> | ||

| + | </td> | ||

| + | <td width=262 style='width:196.2pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Droits de douane : | ||

| + | Indicateur</span></p> | ||

| + | </td> | ||

| + | <td width=401 style='width:300.8pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Indication si oui ou non | ||

| + | la taxe concerne des droits de douane. Par défaut, non.</span></p> | ||

| + | </td> | ||

| + | <td width=81 style='width:60.85pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 align=center style='text-align:center'><span | ||

| + | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>0..1</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Exemption Reason: Code</span></p> | ||

| + | </td> | ||

| + | <td width=262 style='width:196.2pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Exonération : Code</span></p> | ||

| + | </td> | ||

| + | <td width=401 style='width:300.8pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Indication du code de | ||

| + | l'exonération de taxe.</span></p> | ||

| + | </td> | ||

| + | <td width=81 style='width:60.85pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 align=center style='text-align:center'><span | ||

| + | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>*</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | <tr> | ||

| + | <td width=273 style='width:204.7pt;border:solid windowtext 1.0pt;border-top: | ||

| + | none;padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Tax Basis Allowance: Rate</span></p> | ||

| + | </td> | ||

| + | <td width=262 style='width:196.2pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Abattement à la | ||

| + | base : Taux</span></p> | ||

| + | </td> | ||

| + | <td width=401 style='width:300.8pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 style='text-align:justify'><span style='font-size:9.0pt; | ||

| + | font-family:"Arial","sans-serif";font-style:normal'>Indication du taux | ||

| + | d'abattement pour calculer la taxe.</span></p> | ||

| + | </td> | ||

| + | <td width=81 style='width:60.85pt;border-top:none;border-left:none; | ||

| + | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt; | ||

| + | padding:0cm 5.4pt 0cm 5.4pt'> | ||

| + | <p class=Commentaire1 align=center style='text-align:center'><span | ||

| + | style='font-size:9.0pt;font-family:"Arial","sans-serif";font-style:normal'>*</span></p> | ||

| + | </td> | ||

| + | </tr> | ||

| + | </table> | ||

| + | <br> | ||

Version du 29 juin 2011 à 08:48

|

Tax |

Taxe |

Classe regroupant des informations concernant une date ou une période. |

Occurrence |

|

Identification: Identifier |

Identification : Identifiant |

Identification de la taxe. |

0..1 |

|

Calculated: Amount |

Calculé : Montant |

Indication du montant calculé de la taxe. |

0..1 |

|

Type: Code |

Type : Code |

Indication du type de taxe. |

0..1 |

|

Exemption Reason: Text |

Exonération : Text |

Indication en clair de l'exonération de taxe. |

0..1 |

|

Calculated: Rate |

Calculé : Taux |

Indication du taux de la taxe. |

0..1 |

|

Calculation Sequence: Numeric |

Séquence de calcul : Numérique |

Indication du rang de calcul de la taxe comme par exemple : rang 1 calcul de la taxe parafiscale, rang 2 calcul de la TVA. |

0..1 |

|

Basis: Quantity |

Base : Quantité |

Indication d'une quantité pouvant entrer dans le calcul d'une taxe. |

0..1 |

|

Basis: Amount |

Base : Montant |

Indication d'un montant pouvant entrer dans le calcul d'une taxe. |

0..1 |

|

Category: Code |

Catégorie : Code |

Indication de la catégorie pour laquelle la taxe s'applique comme par exemple taux standard, taxe non chargée (voir UNCL 5305). |

0..1 |

|

Currency: Code |

Monnaie : Code |

Indication du code la monnaie de la taxe. |

0..1 |

|

Jurisdiction: Text |

Juridiction : Texte |

Indication de la juridiction pour laquelle la taxe s'applique. |

0..1 |

|

Customs Duty: Indicator |

Droits de douane : Indicateur |

Indication si oui ou non la taxe concerne des droits de douane. Par défaut, non. |

0..1 |

|

Exemption Reason: Code |

Exonération : Code |

Indication du code de l'exonération de taxe. |

* |

|

Tax Basis Allowance: Rate |

Abattement à la base : Taux |

Indication du taux d'abattement pour calculer la taxe. |

* |