|

|

| Ligne 60 : |

Ligne 60 : |

| | <p class=Commentaire1 align=center style='text-align:center'><span | | <p class=Commentaire1 align=center style='text-align:center'><span |

| | style='font-size:9.0pt;font-style:normal'>0..1</span></p> | | style='font-size:9.0pt;font-style:normal'>0..1</span></p> |

| − | </td>

| |

| − | </tr>

| |

| − | </table>

| |

| − | <br>

| |

| − |

| |

| − | === Exemple ===

| |

| − |

| |

| − | <table class=MsoTableGrid border=1 cellspacing=0 cellpadding=0 width=600

| |

| − | style='width:450.0pt;margin-left:5.4pt;border-collapse:collapse;border:none'>

| |

| − | <tr>

| |

| − | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;padding:

| |

| − | 0cm 5.4pt 0cm 5.4pt'>

| |

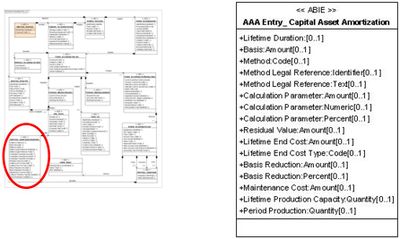

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Durée

| |

| − | de vie : Mesure</span></p>

| |

| − | </td>

| |

| − | <td width=420 style='width:315.0pt;border:solid windowtext 1.0pt;border-left:

| |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>5</span></p>

| |

| − | </td>

| |

| − | </tr>

| |

| − | <tr>

| |

| − | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top:

| |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Base :

| |

| − | Montant</span></p>

| |

| − | </td>

| |

| − | <td width=420 style='width:315.0pt;border-top:none;border-left:none;

| |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>9257,45

| |

| − | (€)</span></p>

| |

| − | </td>

| |

| − | </tr>

| |

| − | <tr>

| |

| − | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top:

| |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Méthode :

| |

| − | Code</span></p>

| |

| − | </td>

| |

| − | <td width=420 style='width:315.0pt;border-top:none;border-left:none;

| |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>12</span></p>

| |

| − | </td>

| |

| − | </tr>

| |

| − | <tr>

| |

| − | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top:

| |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Référence

| |

| − | de la méthode légale : Identifiant</span></p>

| |

| − | </td>

| |

| − | <td width=420 style='width:315.0pt;border-top:none;border-left:none;

| |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>[balise

| |

| − | non utilisée]</span></p>

| |

| − | </td>

| |

| − | </tr>

| |

| − | <tr>

| |

| − | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top:

| |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Référence

| |

| − | de la méthode légale : Texte</span></p>

| |

| − | </td>

| |

| − | <td width=420 style='width:315.0pt;border-top:none;border-left:none;

| |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>[balise

| |

| − | non utilisée]</span></p>

| |

| − | </td>

| |

| − | </tr>

| |

| − | <tr>

| |

| − | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top:

| |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Paramètre

| |

| − | de calcul : Montant</span></p>

| |

| − | </td>

| |

| − | <td width=420 style='width:315.0pt;border-top:none;border-left:none;

| |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>[balise

| |

| − | non utilisée]</span></p>

| |

| − | </td>

| |

| − | </tr>

| |

| − | <tr>

| |

| − | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top:

| |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Paramètre

| |

| − | de calcul : Numérique</span></p>

| |

| − | </td>

| |

| − | <td width=420 style='width:315.0pt;border-top:none;border-left:none;

| |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>[balise

| |

| − | non utilisée]</span></p>

| |

| − | </td>

| |

| − | </tr>

| |

| − | <tr>

| |

| − | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top:

| |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Paramètre

| |

| − | de calcul : Pourcentage</span></p>

| |

| − | </td>

| |

| − | <td width=420 style='width:315.0pt;border-top:none;border-left:none;

| |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>[balise

| |

| − | non utilisée]</span></p>

| |

| − | </td>

| |

| − | </tr>

| |

| − | <tr>

| |

| − | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top:

| |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Valeur

| |

| − | résiduelle : Montant</span></p>

| |

| − | </td>

| |

| − | <td width=420 style='width:315.0pt;border-top:none;border-left:none;

| |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>750,00

| |

| − | (€)</span></p>

| |

| − | </td>

| |

| − | </tr>

| |

| − | <tr>

| |

| − | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top:

| |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Coût à

| |

| − | la fin de vie : Montant</span></p>

| |

| − | </td>

| |

| − | <td width=420 style='width:315.0pt;border-top:none;border-left:none;

| |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>278,00

| |

| − | (€)</span></p>

| |

| − | </td>

| |

| − | </tr>

| |

| − | <tr>

| |

| − | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top:

| |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Coût à

| |

| − | la fin de vie : Code</span></p>

| |

| − | </td>

| |

| − | <td width=420 style='width:315.0pt;border-top:none;border-left:none;

| |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>2</span></p>

| |

| − | </td>

| |

| − | </tr>

| |

| − | <tr>

| |

| − | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top:

| |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Abattement

| |

| − | à la base : Montant</span></p>

| |

| − | </td>

| |

| − | <td width=420 style='width:315.0pt;border-top:none;border-left:none;

| |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>[balise

| |

| − | non utilisée]</span></p>

| |

| − | </td>

| |

| − | </tr>

| |

| − | <tr>

| |

| − | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top:

| |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Abattement

| |

| − | à la base : Pourcentage</span></p>

| |

| − | </td>

| |

| − | <td width=420 style='width:315.0pt;border-top:none;border-left:none;

| |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>[balise

| |

| − | non utilisée]</span></p>

| |

| − | </td>

| |

| − | </tr>

| |

| − | <tr>

| |

| − | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top:

| |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Coût de

| |

| − | la maintenance : Montant</span></p>

| |

| − | </td>

| |

| − | <td width=420 style='width:315.0pt;border-top:none;border-left:none;

| |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>125,00

| |

| − | (€)</span></p>

| |

| − | </td>

| |

| − | </tr>

| |

| − | <tr>

| |

| − | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top:

| |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Capacité

| |

| − | de production sur la durée de vie : Quantité</span></p>

| |

| − | </td>

| |

| − | <td width=420 style='width:315.0pt;border-top:none;border-left:none;

| |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>[balise

| |

| − | non utilisée]</span></p>

| |

| − | </td>

| |

| − | </tr>

| |

| − | <tr>

| |

| − | <td width=180 style='width:135.0pt;border:solid windowtext 1.0pt;border-top:

| |

| − | none;padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>Production

| |

| − | par période : Quantité</span></p>

| |

| − | </td>

| |

| − | <td width=420 style='width:315.0pt;border-top:none;border-left:none;

| |

| − | border-bottom:solid windowtext 1.0pt;border-right:solid windowtext 1.0pt;

| |

| − | padding:0cm 5.4pt 0cm 5.4pt'>

| |

| − | <p class=Commentaire1><span style='font-size:9.0pt;font-style:normal'>[balise

| |

| − | non utilisée]</span></p>

| |

| | </td> | | </td> |

| | </tr> | | </tr> |

Il s'agit ici de recueillir les informations connues au moment de l'enregistrement de la facture dans le système comptable. Les autres informations seront saisies ou recueillies ultérieurement par un message approprié issu du logiciel de gestion des immobilisations.