Business process elaboration – Order to payment

Sommaire

Scope

The process describes how customer and supplier can provide Accounting Token elements to enable automated generation of accounting entry from the e-document is used at each step in the supply chain.

Principles

From the earliest step, which is the Order from the customer, and the Order Confirmation of the supplier, the Accounting Token is encapsulated in each business documents.

The Order Confirmation is the required starting point of the Order process for the generation of the accounting entry, coherent with generally admitted accounting principles (GAAP).

Thus, an Order Change must always be followed by an Order Confirmation to allow the correct generation of the accounting entry reflecting the confirmed Order Change.

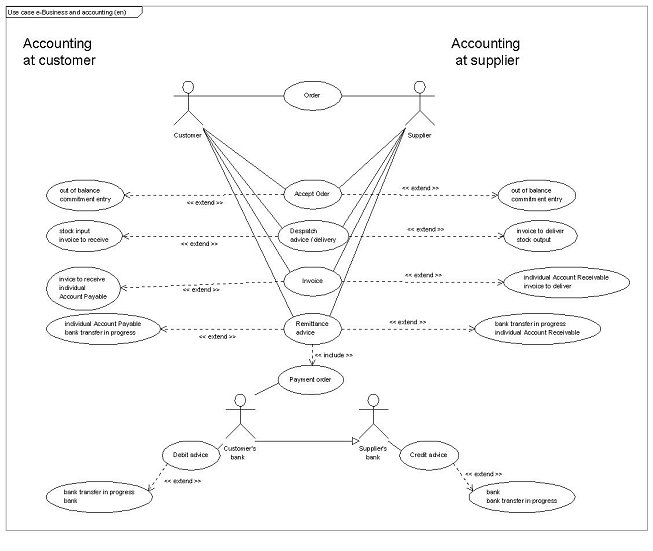

Use case: From Accounting Token into Order to Accounting Token into Payment

The use case shows when accounting and which accounts may be concerned at both trading partners

Use case description – Accounting Token into the Order

|

Identifier |

From Order Process to Payment Process |

|

Actors |

Customer |

|

Description |

To provide at the ordering process the Accounting Token information of the customer needed to support accounting entries generation during the chosen steps of the supply chain process. |

|

Pre-condition |

Parties agreed to provide the Accounting Token information. |

|

Post-conditions |

The next step in the sequence to be considered for accounting entry generation must be a confirmation of the order. |

|

Scenario |

With respect to accounting principles applied accounting entry is created to record commitment into “out of balance accounts” and / or budgetary accounts. |

|

Remarks |

Considering the

current general practice, SME’s do not record this kind of commitment. |

|

Business process name |

Accounting Token into the Order |

|

Identifier |

From Order Process to Payment Process |

|

Actors |

Supplier |

|

Description |

At the ordering process the supplier receives the Accounting Token information of the customer needed to support accounting entries generation. It is expected that the supplier sends it back during the chosen steps of the supply chain process. |

|

Pre-condition |

Parties agreed to provide the Accounting Token information. |

|

Post-conditions |

The Accounting Token received from the customer is stored to be (re-)sent to the customer when needed. |

|

Scenario |

|

|

Remarks |

No influence on supplier’s accounting figures; From supplier’s accounting view, the next step in the sequence to consider for accounting entry generation must be the Order Confirmation which means a firm commitment to provide the services or goods. |

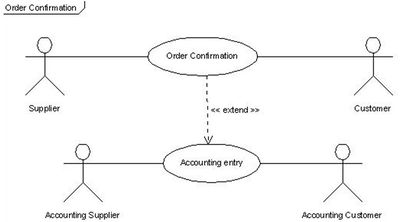

Use case description – Accounting Token into the Order confirmation

|

Business process name</b> </td> |

Accounting Token into the Order confirmation. </td> </tr> | ||||||||||||||||

|

<b>Identifier</b> </td> |

From Order Process to Payment Process. </td> </tr> | ||||||||||||||||

|

<b>Actors</b> </td> |

Supplier </td> </tr> | ||||||||||||||||

|

<b>Description</b> </td> |

The Order Confirmation contains the Accounting Token information of the customer. It possibly provides the Accounting Token information of the supplier needed to support accounting entries generation at this step supply chain process. </td> </tr> | ||||||||||||||||

|

<b>Pre-condition</b> </td> |

Customer’s Accounting Token has been included into the Order message and given back. Parties agreed to provide the Accounting Token information. </td> </tr> | ||||||||||||||||

|

<b>Post-conditions</b> </td> |

The value of each line and the total value of the order confirmation must be provided on the order confirmation. </td> </tr> | ||||||||||||||||

|

<b>Scenario</b> </td> |

The order confirmation acts the commitment of both parties. Accounting entry possibly occurs to record commitment into “out of balance accounts” and / or budgetary accounts into accounting accounts of the supplier and those of the customer. The Accounting Token of the supplier is needed when accounting books are kept outside of the entity, e.g. at an external accounting firm. </td> </tr> | ||||||||||||||||

|

<b>Remarks</b> </td> |

Considering the current general practice, SME’s do not often record commitment. Implementing accounting entries from this step onward shall translate a better view of the reality in the accounts. Future web services will enable to stick business steps figures with account’s ones and consequently improve the fairness, accurateness and timeliness of accounting books. </td> </tr> </table>

|