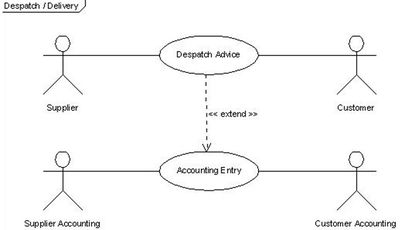

Use case description – Accounting Token into the Despatch Advice

|

Business process name |

Accounting Token into the Despatch Advice |

|

Identifier |

From Order Process to Payment Process. |

|

Actors |

Supplier. |

|

Description |

The supplier confirms despatch quantities of ordered goods and possibly acts stock outflow. The Despatch Advice contains the Accounting Token information of the customer. It possibly provides the Accounting Token information of the supplier needed to support accounting entries generation at this step supply chain process. |

|

Pre-condition |

Customer’s Accounting Token has been included into the Order message and given back. Parties agreed to provide the Accounting Token information. The value of each line and the total value of the order confirmation must be provided on the order confirmation. |

|

Post-conditions |

At supplier’s accounting side, accounting entry to be possibly generated by an appropriate software tool. |

|

Scenario |

a) Stock outflow entry to be booked with a counterpart “invoice to prepare”. b) In case commitment “out of balance accounts” and / or budgetary accounts was recorded, the [complete or partial] fulfilment of the commitment is acted by reversing [totally or partially] the original entry. |

|

Remarks |

|

|

Business process name |

Accounting Token into the Despatch Advice |

|

Identifier |

From Order Process to Payment Process |

|

Actors |

Customer |

|

Description |

The Despatch Advice of quantities acts the transfer of responsibility on the delivered goods. This must be translated into accounting entries. The Despatch Advice contains the Accounting Token information of the customer. |

|

Pre-condition |

Customer’s Accounting Token was included into the Order. Customer’s Accounting Token is reproduced without change on the Despatch Advice. The value of each line and the total value of the order confirmation must be provided on the Despatch Advice. |

|

Post-conditions |

Accounting entry to be generated by an appropriate software tool. |

|

Scenario |

a) Stock inflow entry to be booked with a counterpart “invoice to receive”. b) In case commitment “out of balance accounts” and / or budgetary accounts was recorded, the [complete or partial] fulfilment of the commitment is acted by reversing [totally or partially] the original entry; |

|

Remarks |

|