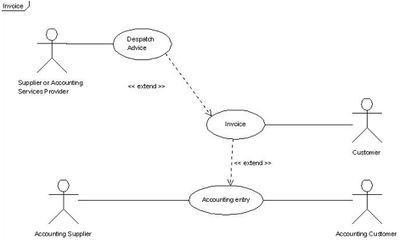

Use case description – Accounting Token into the Normal invoice

|

Business process name |

Accounting Token into the Normal Invoice |

|

Identifier |

From Order Process to Payment Process |

|

Actors |

Supplier |

|

Description |

The supplier produces the invoice on basis of the despatch quantities of products or services. This invoice must be translated into accounting entries and conform to fiscal requirements. The Invoice contains the Accounting Token information of the customer. It possibly provides the Accounting Token information of the supplier needed to support accounting entries generation at this step supply chain process. |

|

Pre-condition |

Customer’s Accounting Token has been included into the Order message and given back. Parties agreed to provide the Accounting Token information. The value of each line and the total value must be provided on the invoice. |

|

Post-conditions |

At supplier’s accounting side, accounting entry to be possibly generated by an appropriate software tool. |

|

Scenario |

Invoice can be produced either by the supplier or by a service provider on basis of despatch advices where values have been calculated in advance. In supplier’s accounting books, “Invoice to produce” to be balanced with individual account receivable. |

|

Remarks |

|

|

Business process name |

Accounting Token into the Normal Invoice |

|

Identifier |

From Order Process to Payment Process |

|

Actors |

Customer |

|

Description |

The customer receives the invoice on basis of the despatch quantities of products or services. This invoice must be translated into accounting entries and conform to fiscal requirements. The Invoice contains the Accounting Token information of the customer. |

|

Pre-condition |

Customer’s Accounting Token is reproduced without change on Invoice |

|

Post-conditions |

Invoice is validated and approved by the right authority. Accounting entry to be generated by an appropriate software tool. |

|

Scenario |

Invoice can be produced either by the supplier or by a service provider on basis of despatch advices where values have been calculated in advance. In customer’s accounting books, “Invoice to receive” to be balanced with individual account payable. |

|

Remarks |

|