Business process elaboration – Order to payment

Sommaire

Scope

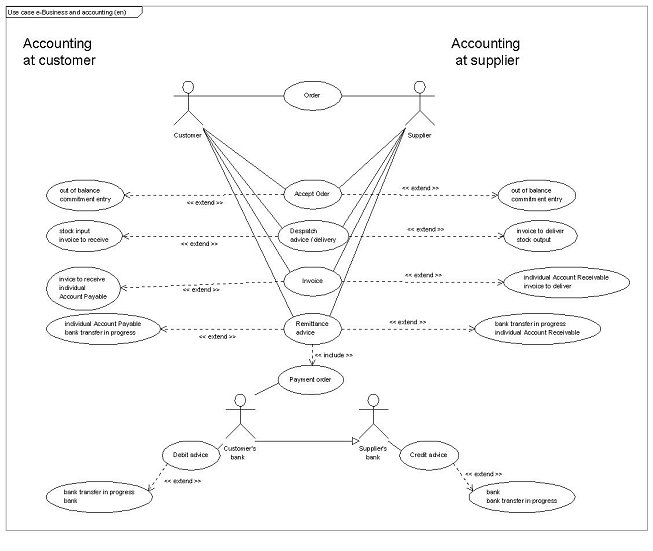

The process describes how customer and supplier can provide Accounting Token elements to enable automated generation of accounting entry from the e-document is used at each step in the supply chain.

Principles

From the earliest step, which is the Order from the customer, and the Order Confirmation of the supplier, the Accounting Token is encapsulated in each business documents.

The Order Confirmation is the required starting point of the Order process for the generation of the accounting entry, coherent with generally admitted accounting principles (GAAP).

Thus, an Order Change must always be followed by an Order Confirmation to allow the correct generation of the accounting entry reflecting the confirmed Order Change.

Use case: From Accounting Token into Order to Accounting Token into Payment

The use case shows when accounting and which accounts may be concerned at both trading partners.

- Use case description – Accounting Token into the Order

- Use case description – Accounting Token into the Order confirmation

- Use case description – Accounting Token into the Despatch Advice

- Use case description – Accounting Token into the Normal invoice

- Use case description – Accounting Token into the Self Billing invoice

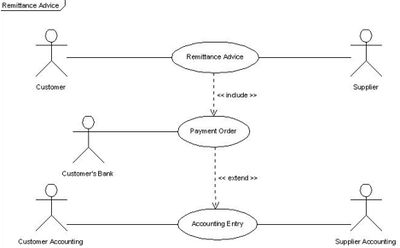

Use case description – Accounting Token into the Remittance Advice

|

Business process name |

Accounting Token into the Remittance Advice |

|

Identifier |

From Order Process to Payment Process |

|

Actors |

Customer |

|

Description |

The customer provides to the supplier the invoice(s) identifier(s) for which a global payment order is simultaneously transmitted to the customer’s bank. The Remittance Advice contains the Accounting Token information of the customer. The Remittance Advice possibly contains the Accounting Token information of the supplier. |

|

Pre-condition |

Customer’s Accounting Token is reproduced without change on Remittance Advice. Supplier’s Accounting Token is possibly reproduced without change on Remittance Advice. |

|

Post-conditions |

Accounting entry to be generated by an appropriate software tool. |

|

Scenario |

Amount recorded in individual Account Payable matching the detailed amounts of invoices paid. The counterpart is “Payment in Progress” (which will be balanced at receipt of the bank statement of account acting the actual payment). |

|

Remarks |

|

|

Business process name |

Accounting Token into the Remittance Advice |

|

Identifier |

From Order Process to Payment Process |

|

Actors |

Supplier |

|

Description |

The supplier receives notice of the invoice(s) identifier(s) for which the customer transmits simultaneously a global payment order to his bank. |

|

Pre-condition |

Supplier’s Accounting Token is reproduced without change on the Remittance Advice. |

|

Post-conditions |

Accounting entry to be generated by an appropriate software tool. |

|

Scenario |

Entry recorded in individual Receivable Account Payable preferably matching the detailed amounts of the invoices paid. The counterpart must be Payment in Progress (which will be balanced at receipt of the bank statement of account acting the actual payment). |

|

Remarks |

|

Element Identification

The elements below make up the Business Information Entity representing the Accounting Token based upon the existing ACC “Accounting Account. Details” as logged into Core Components Library 06B.

The BIE is repeated as many times as requested by the accounting procedure applied in the entity e.g. general account, sub account, cost accounting account, budget account, or account directly related to a specific amount on a document (e.g. insurance cost amount, additional invoice amount, transport amount, etc.)